We are an empire now, and when we act, we create our own reality.

– Journalist Ron Suskind quoting

unnamed George W. Bush advisor in

a 2004 New Yorker essay.

There it is again – the invocation for most of the 20th century. But – wait: aren’t we in the 21st century? Well, really – not yet in any way that matters. President Biden tried, through his big beautiful legislative acts (two of them), to nudge and cajole us into the early 21st century: beginning to commence to proceed to address the scientific reality of a climate that our created realities have been inadvertently changing for the worse, and the socioeconomic realities of an increasingly inequitable society that unbridled private capitalism has been advertently imposing on us all. But Biden’s acts no longer address our official realities.

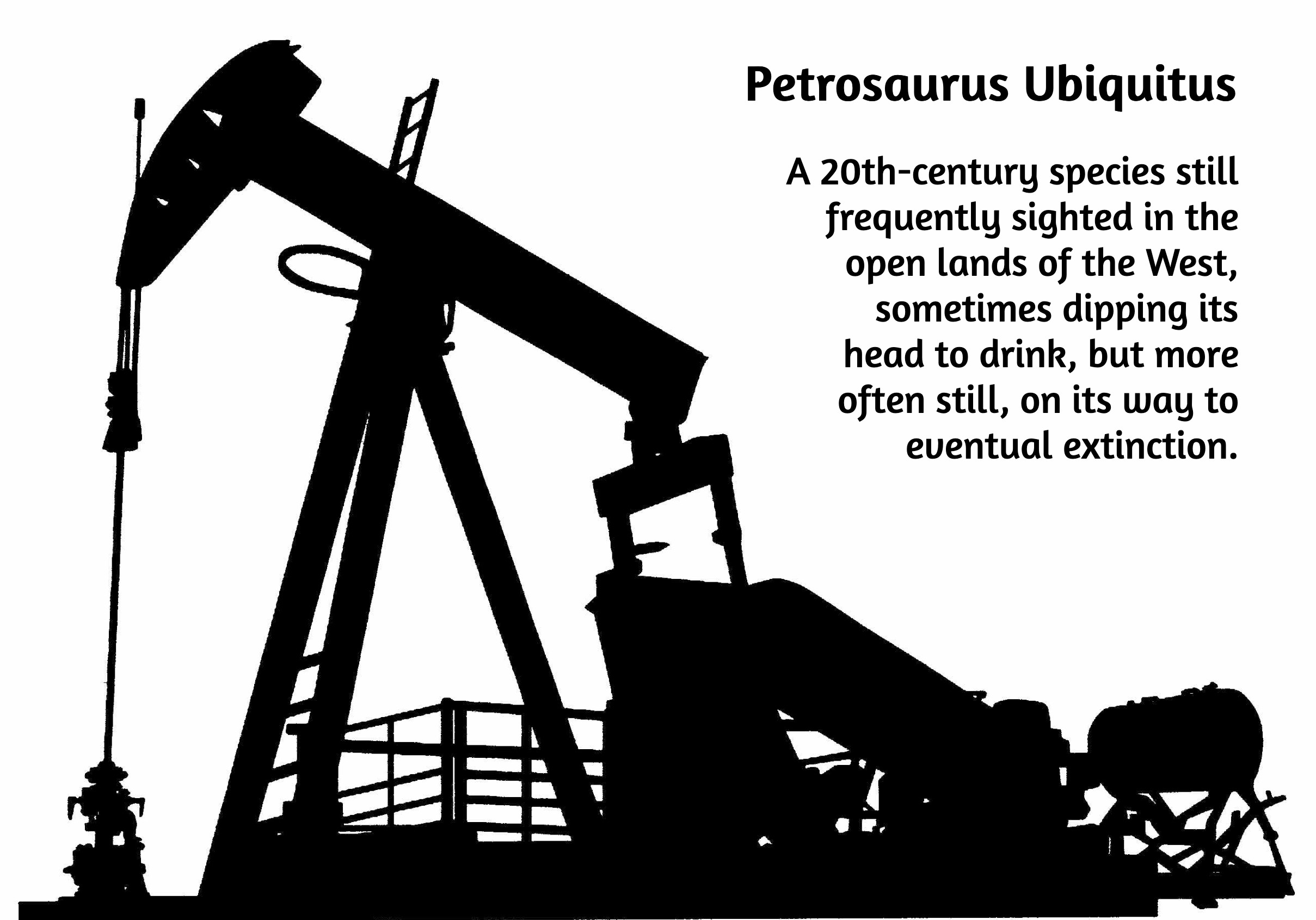

The new official reality, which wants to take us back to the good old days of the mid-20th century, includes a full restitution of the fossil energies (including beautiful clean coal) that, a mere seven months ago, we were told we needed to stop using as soon as we possibly could for the sake of our continued existence on the planet. Trump may have missed a couple ‘first day’ promises – low grocery prices and peace in the Ukraine – but one first-day promise he did fulfill was issuing an executive order on January 20, 2025 for ‘Unleashing American Energy,’ colloquially known as ‘Drill, baby, drill.’

Therein, Trump explained that ‘in recent years, burdensome and ideologically motivated regulations have impeded the development of these (fossil) resources,’ inflicting ‘high energy costs upon our citizens … driving up the cost of transportation, heating, utilities, farming, and manufacturing, while weakening our national security.’ Trump proclaimed that this constituted a ‘National Energy Emergency’ caused by President Biden and other liberals obsessed by a ‘climate crisis’ that is now, almost magically, no longer an official part of American reality.

Biden-era policies, according to this MAGA narrative, kept energy development off of the public lands by ‘locking the lands up’ for conservation, preservation and recreation, making Biden’s administration responsible for our high gasoline and home-heating prices. And the Trump administration was going to reverse that by reopening the public lands for the O&G industry to drill new wells, increasing the supply of gas and oil to both bring down O&G costs and re-establish America’s global energy dominance – a dominance in O&G production that we already in fact have.

Trump’s Interior Secretary Doug Burgum followed this up February 3, 2025 with a seven-page order revoking all of President Biden’s energy-related executive orders dating back to 2021, and replacing them with orders specific to ‘drill, baby, drill.’

But there is a problem they are not acknowledging, however: is the O&G industry really going to get out there and ‘drill, baby, drill’? The truth, as usual with Trump, lies elsewhere….

Let’s take a look at how the leasing process goes, on our Bureau of Land Management lands (with similar rules on the National Forests):

- First, someone from the public – usually someone from the O&G industry – expresses interest in a piece of land for oil or gas production. The BLM then has to prepare a lease sale for that land. Biden rules put in force last year (now rescinded) restricted this to lands with some probability of actual O&G resources in the land.

- Once requested lands are mapped into lease units (maximum lease 2,560 acres in the lower 48 states, 5,760 acres in Alaska), the BLM holds quarterly auctions to lease the mapped units. The 2024 rules (now rescinded) raised the minimum bid from $2/acre to $10/acre, and also declined to sell the leases when there was no competitive bidding.

The leases are for 10 years (renewable in some cases), with rental at $3/acre for the first two years, $5/acre for the next six years, and $15/acre for any year thereafter – obvious incentive to get a lease into production. - Before leaseholders can do anything on the land, they need to put up a bond to cover the cost of closing-off and site reclamation when they abandon the well (after 4 years with no action). The minimum bond was increased in 2024 from $10,000 to $150,000, making forfeiture painful (now rescinded).

- When leaseholders are ready to ‘develop’ a lease, they apply for a drilling permit. If their drilling plan is approved by the BLM (more than 95 percent are), they pay a permitting fee (minimum $10,000) and can then ‘drill, baby, drill.’ Biden rules (now reduced again) charged a 16.67 percent royalty to the government on what they produce.

- Oil wells can be operated as long as they are profitable, with lease extensions. When they are no longer producing enough to profitably cover lease rent plus operating expenses, the company owning the lease is responsible for closing down the well and restoring the land.

Did the ‘Biden-era’ government ‘shut down’ this leasing and permitting process, ‘locking out’ energy development, as the Trump administration and the O&G industry claim? Hardly; that’s just more Trumpty-Dumpty fake news. Anyone with a cultural memory that goes back further than 2025 will remember that environmental interests were constantly haranguing the Biden administration to stop the leasing on public lands, since it undermined the administration’s other efforts to address the climate crisis, which was then officially part of our reality, like it or not. It is also part of our reality, however, that our need for gasoline and natural gas has not diminished much, and Biden had to work for a balance no one liked. Anyone wanting to revisit the kind of pressure from both sides that Biden and his Interior Department encountered on such issues could look at this AP story about leases in Alaska’s far frozen north.

There’s a more important fact (remember ‘facts’?) to keep in mind about the leasing situation, however, and Trumpish complaints that the government is blocking our energy dominance on the planet: 25 million acres of public land are currently reserved in O&G leases, but at least a third of that, maybe more, is in leases that have not been developed. Let me say that again: the O&G industry already holds several thousand leases that it has not begun to bring into production.

Two questions rise: Why are they not developing these leases on which they are paying rent? And why are they agitating for even more leases?

The answer to the first question is the most obvious: they do not want to bring more wells into production because the price of a barrel of oil has been dropping below their industrial break-even price of around $65/barrel. Energy production is governed to some extent by a calculation called the ER:EI – ‘Energy Return on Energy Investment.’ In the good old days of 30-cents-a-gallon gasoline, oil was ‘gushing’ abundantly from wells. The ER:EI of oil then ranged from 20:1 upward, depending on how fast it flowed and how far it had to go to market – meaning 20 barrels were produced for every barrel-equivalent of energy invested.

The miracle of ‘fracking’ opened up vast new regions from which oil could be squeezed, but fracked oil does not gush; instead it has to be freed from rock formations with complex and expensive drilling and pumping procedures. The ER:EI of fracked petroleum and natural gas is 5:1 or often lower. The O&G frackers need barrel prices above $65 to even begin making a profit.

Recent rumors of war in the Mideast have pushed the price up to the $70-75/barrel range, but that is a fluctuating situation that will not be reflected at the gas pump. And that may be countered by the OPEC+ nations (all the Arabian nation-states plus Russia and a handful of other non-Arabian states), who just upped the ante. They still have oil they can access at an ER:EI significantly above that of the United States frackers – and they recently voted to increase their production June 1 by an additional 411,000 barrels a day, which pretty well insures that the global prices of a barrel will not go up to where United States frackers will want to start developing the thousands of leases they are paying rent on. Unless, perhaps, Trump decides to put a tariff on OPEC oil and gas, with all the political chaos that would create – including driving up the price of gasoline and heating gas here.

So therein lies the truth about who is responsible for persisting higher gas prices: it wasn’t the Biden administration shutting off opportunities; it was the O&G industries refusing to develop low-cost public-land opportunities they already owned – not wanting to produce oil and gas at a loss as a patriotic MAGA gesture. America has no more ‘cheap’ oil with the massive profitability of a high ER:EI.

But at any rate, if we do actually have a ‘national energy emergency,’ it is certainly not going to be resolved by putting a lot more public land up for leases to ‘unleash’ America’s fossil energy, with more than a third of the public land already leased but not developed due to low energy prices. A January lease offer – Biden’s last – in the Arctic National Wildlife Refuge had no bidders.

So why the big push for more public lands leasing?

Well, in Trumpland it may not be about lower prices for consumers at all, but about industrial control in the public lands. An O&G lease, so long as the rent is paid – pocket change for the industry – amounts to a priority use on public lands managed for multiple uses. So long as a lease remains undeveloped, it can’t be fenced; it is open for grazing cattle, hikers, bikers and other ‘multiple-users’ to wander over. But the O&G company has the priority use on the land, and if it decides to develop the lease, the surface land needed for the drilling and pumping operations becomes single-use land, with a road leading into it – no longer really ‘public’ or ‘multiple use’ for so long as the well operates.

As noted in the leasing and permitting process outlined above, the drilling company has to put up a bond assuring that it will properly shut down and plug the well and reclaim the area when the well runs out. The historic $10,000 bond was so low that companies found it cheaper to just forfeit the bond and leave it leaking methane into the atmosphere, polluting the underground water table, and surrounded by the refuse from the fracking operation. The Biden administration raised the bond for a permit to drill to $150,000, about twice the current average reclamation cost, and enough to make some miners/drillers to think twice about just abandoning the well. Now, of course, that Biden-era move toward good sense is being rescinded.

How many ‘orphaned wells’ are there (abandoned with little or no reclamation)? No one seems to know for sure. The EPA estimates there are as many as four million abandoned wells nationwide, most plugged to some degree with known owners and operators; but some 100-150 thousand of the abandoned wells are orphaned – no financially solvent owner-operator can be found, and many of those are not plugged, and are emitting methane into the atmosphere and oil and toxic fracking fluids into water tables. Those numbers are more guesstimates than estimates, and no one really knows how many of the orphaned wells are on public lands, but we taxpayers will end up paying to plug, clean up and maintain the orphans, as (chronically inadequate) budgets allow (2024 information).

There may be another rationale behind the O&G industries’ desire for more leasing and permitting, when they aren’t developing a third of what they already have. There is a huge overlap between the 90 percent of BLM land that is open for O&G leasing at the request of the industry, and the BLM land that is suitable for the development of the massive solar, wind and geothermal renewable energy resources that will be needed when American reality again encompasses the climate crisis. Leasing processes have been worked out for renewable energy development – somewhat more rigorous than those for the O&G industry – and many of the suitable sites find an O&G lease right in the middle of them, with its undeveloped use priority. The developers of the renewables have to buy surface-use waivers from the O&G leaseholders – unless the O&G leaseholders don’t want to give up the chance to develop their non-renewables.

Well – enough said on this. I hope this disabuses you of the Trumpty-Burgumty nonsense about a ‘national energy emergency’ that can be resolved through a wide-open assault on our public lands. That’s the good news; the bad news is the fact that gasoline at the pump is probably never going to go down much, so long as a barrel of oil has to bring more than $70 to the fossil-fuel producer.

An intelligent and forward-looking society would be working to gently and fairly phase out the truculent O&G industries, and phase in the renewable energy resources with a lot of job creation – which the Biden administration, now seemingly maligned by everyone, was actually trying to do with the two big beautiful infrastructure acts that the Trumpty-Burgumties are trying to rescind as thoroughly as possible, for no discernible reasons other than their own ‘creative reality,’ and of course, with Trump, vengeance on his enemies.

The Trumpty-Burgumty teams have come up with some other plans for the public lands, including selling off some of them – a lemon from which it might actually be possible to squeeze some lemonade, depending on how it shakes out. More about that in the future, when we see if it stays in the Big Piggy Bill….

Next post – back to the Colorado River where, believe it or not, things are pretty much still where they were a year ago – which is to say ‘a standstill’ – at least in terms of a new management plan for the post-2026 era. Stay tuned.

Great article. Sums up the energy situation exactly as it is. Even the WSJ covered some of this in their 6-24-25 issue. Your article was better in explaining the implications and more in-depth. The mis-direction by Trump and his administration ( on so many topics including the “drill, baby drill” stunt ) and dismantling of Biden’s energy policies is depressing. I think history will view the Trump regime as a egotistical failure.

I think Trump runs on the ‘winner-takes-all’ conviction; if he can keep winning (and right now, he is), he’ll get it all including the historians. All we can say right now is that it has never worked out yet for the grasping sociopaths like Trump….

No mention is ever made that petroleum is in fact a non replaceable finite quantity. It should be used in the most efficient way . Regardless of how much there is in reserve , when it’s gone – it’s gone forever.

The trumpist folks seem to assume the supply will last forever- not true .

I love your perspective , George, thanx again for continuing the narrative.

David Uhlendorf

That’s the ultimate truth of the resource and energy games, David; everything eventually runs out on a fairly short schedule as our use expands. The sun (and the wind it drives) are the dependable exceptions. The sun will eventually burn itself out, but not a schedule relevant to humankind today….

The eye-opener to me is your pointing out the “overlap” on public land of o&g and solar/wind being a (perhaps the) reason for this rescinding of Biden’s policies and o&g’s otherwise economically unsound reason for maintaining interest, ie: blocking renewables’ development. Thanks again, Perfesser, for all this bad news.

Well said, George. (Painful to read, as is most of Trump news).

It reminded me too of the new book I started work on (sorry!). The title is “The Rise and Fail? of the Human Empire’. Unfortunately, or fortunately, this one will take awhile (f I live that long). ken

Thanks, George, and I look forward to returning to to THE Colorado.